A guide to conditional payments

Product

28 Apr 2023

Frederik Fuglsbjerg, Marketing

Conditional payments have become increasingly popular in recent years, as businesses look for ways to improve their financial performance while also promoting trust and transparency in their relationships with suppliers. At ZTLment, we understand the importance of these payment structures and how they can help our clients unlock growth opportunities.

__________________________

What are conditional payments and how are they different from traditional payment models?

In a traditional payment model, businesses pay suppliers based on a fixed schedule, regardless of the quality of work or the success of the project. This can create a lack of motivation for the supplier to deliver high-quality work or meet project objectives, and it can also lead to distrust between the buyer and the supplier.

Conditional payments, on the other hand, tie payment to specific outcomes or milestones that have been agreed upon in advance by both parties. This creates a clear and transparent relationship between the buyer and the supplier, with both parties working together towards a shared goal.

What are the benefits of conditional payments?

For businesses that want and need to build trust, such as in the net zero economy, or process a high volume of payments between many stakeholders, conditional payments help turn the finance team into a growth driver, rather than a bottleneck for growth.

Some of the core benefits of conditional payments are; automation, risk reduction, trust, ease of use, and end-to-end transparency. Let's dive into some of these to explain how conditional payments enable these benefits.

1) Automation of finance workflows

Conditional payments can be automated, which reduces the administrative burden on finance teams. With clear milestones and outcomes agreed upon in advance, the payment process can be automated to release funds to suppliers when certain conditions are met. This can help businesses streamline their payment processes and reduce the risk of errors or delays.

2) Reduce risk of human error and financial risk

Conditional payments can reduce risk for both buyers and suppliers, including the risk of human error. By tying payment to specific outcomes or milestones, buyers can ensure that they are only paying for work that has been completed to their satisfaction. This can reduce the risk of mistakes or oversights in the payment process. Meanwhile, suppliers are incentivised to meet project objectives and deliver high-quality work in order to receive payment, which can reduce the risk of disputes over invoicing or quality issues.

3) Stronger trust building with stakeholders

Conditional payments promote trust between buyers and suppliers by creating a transparent and mutually beneficial relationship. With clear expectations and outcomes agreed upon in advance, both parties can work together towards a shared goal. This can help build trust between the parties, which can lead to more successful collaborations and long-term partnerships.

4) End-to-end transparency

Conditional payments provide end-to-end transparency for all stakeholders involved in a transaction. With clear expectations and outcomes agreed upon in advance, everyone involved in the transaction understands what needs to be done and what payment will be received for that work. This can help reduce the risk of misunderstandings or disputes, and can improve overall transparency in business transactions. In addition, because ZTLment has built our payments infrastructure on blockchain technology, our customers can leverage extra transparency from their ledger of transactions in their Dashboard.

5) Ease of use with ZTLment

Conditional payments can be somewhat of a pain to set up if you do not have the proper tools in place to do so efficiently. At ZTLment, we have built our entire toolkit around enabling the best possible user experience for creating and executing conditional payments, which enables businesses to get started in 3 different ways:

Build out a transaction plan in our Dashboard.

Easily import a CSV file that outlines your transaction plan

Or for end-to-end automation, integrate our APIs into your own backend or cloud system so that you can use data events to trigger payments automatically.

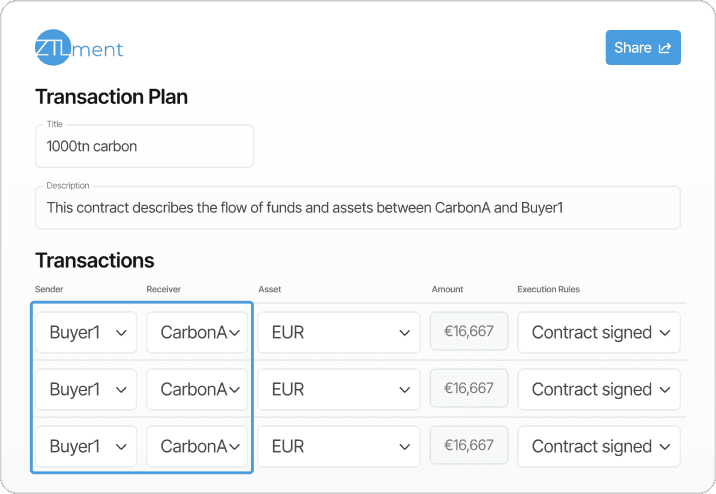

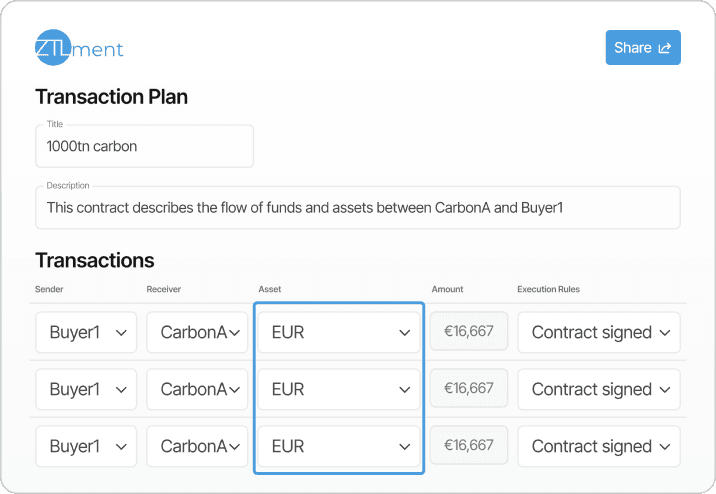

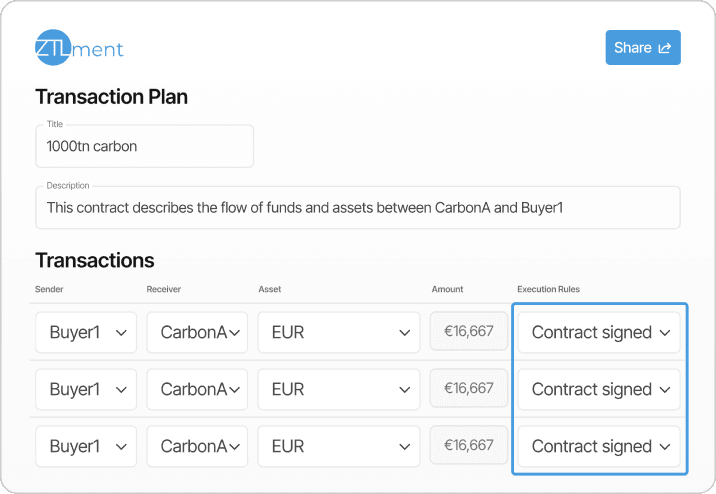

Creating a transaction plan in the ZTLment Dashboard in four simple steps:

1) Select sender(s) and receiver(s) who will send and receive assets and money through the transaction plan

2) Specify asset type being transferred and upload supporting documentation for that asset for end-to-end transparency

3) Customise payment conditions to specified execution rules for full automation and trust building

4) Easily share your transaction plan with your respective stakeholder(s) for approval

Want to know more?

Recent posts

deGrazie speeds up their payout process with ZTLment

24 Apr 2024

How Delayed Payments Can Affect Supplier Relations

2 Apr 2024

ZTLment X Monerium: Automating Complex Payout Processes with Regulated On-Chain Infrastructure

14 Mar 2024

ZTLment strengthens board with three experienced profiles

30 Nov 2023

Simplifying Payouts: A Leap into the Future of Business Transactions

17 Oct 2023

ZTLment Receives Unique European-Wide Licence To Automate Business Payouts Using Fiat Money On Blockchain

13 Oct 2023

Automate Complex Business Payouts with ZTLment's Smart Contract Technology

7 Sept 2023

Create, execute and reconcile Bulk Payouts in under 30 seconds with ZTLment

9 Aug 2023

Pioneering data-driven finance for customisable and fully automated payment flows

1 Aug 2023

July 2023 Newsletter

31 Jul 2023

ZTLment Partners With Deloitte and KPI OceanConnect

7 Jul 2023

Revolutionizing Payout Flows: From Manual Intervention to Smart Contract Automation

22 Jun 2023

June 2023 Newsletter

17 Jun 2023

Automating Payouts & The Costs of Manual Payout Processes

7 Jun 2023

May 2023 Newsletter

24 May 2023

Scaling the energy market: blockers and solutions

22 May 2023

Overcoming Challenges in Carbon Project Financing

19 May 2023

Demystifying blockchain: the future of finance with ZTLment

11 May 2023

A single ledger for certificates and money

9 May 2023

ZTLment featured in MIT's "4 business approaches to blockchain"

28 Apr 2023

Trust and transparency in the net zero economy

28 Apr 2023

April 2023 Newsletter

17 Apr 2023

Agreena goes 'first-ever' on blockchain with ZTLment: tokenized carbon crediting attached to real currency

3 Nov 2022

ZTLment becomes Europe's first regulated payments institution with the Danish FSA

4 Feb 2022