Pioneering data-driven finance for customisable and fully automated payment flows

Payments

1 Aug 2023

Stefan Nielsen, CCO

Data has become the lifeblood of the modern economy. Companies rely on data for insights on the market and their competition; for optimising their supply chain; for developing a better product for their customers.

Data is used by cutting-edge companies to optimise their operations across almost every department in their organisation in every facet of their operations, but has yet to be utilised to operate one crucial part of their day-to-day work: payments.

Just like data, payments are at the core of every company. It is how you build lasting relationships with customers, it is how you keep your business afloat, and its a big part of retaining your user base on your platform.

The limitations of current payment infrastructure

Companies are starting to realize the inherent limitations of building on top of outdated banking rails - many of which have been built dated back to the 70s.

Open banking APIs are one-dimensional, allowing companies to support simple payment flows, such as when you buy a t-shirt online or when charging customers a recurring fee every month.

But companies need payment flows that are intuitive and customisable - something that is centred around how they do business!

While open banking introduced some connectivity to the payments landscape, it still relies heavily on integrating with numerous banks to be somewhat useful.

Building payment flows that work for you, not against you

Our core product philosophy at ZTLment is centred around “finance workflows, without the work”. We are enabling finance teams to become fully data-driven in their operations, which involves:

Customising and automating the payment creation flow

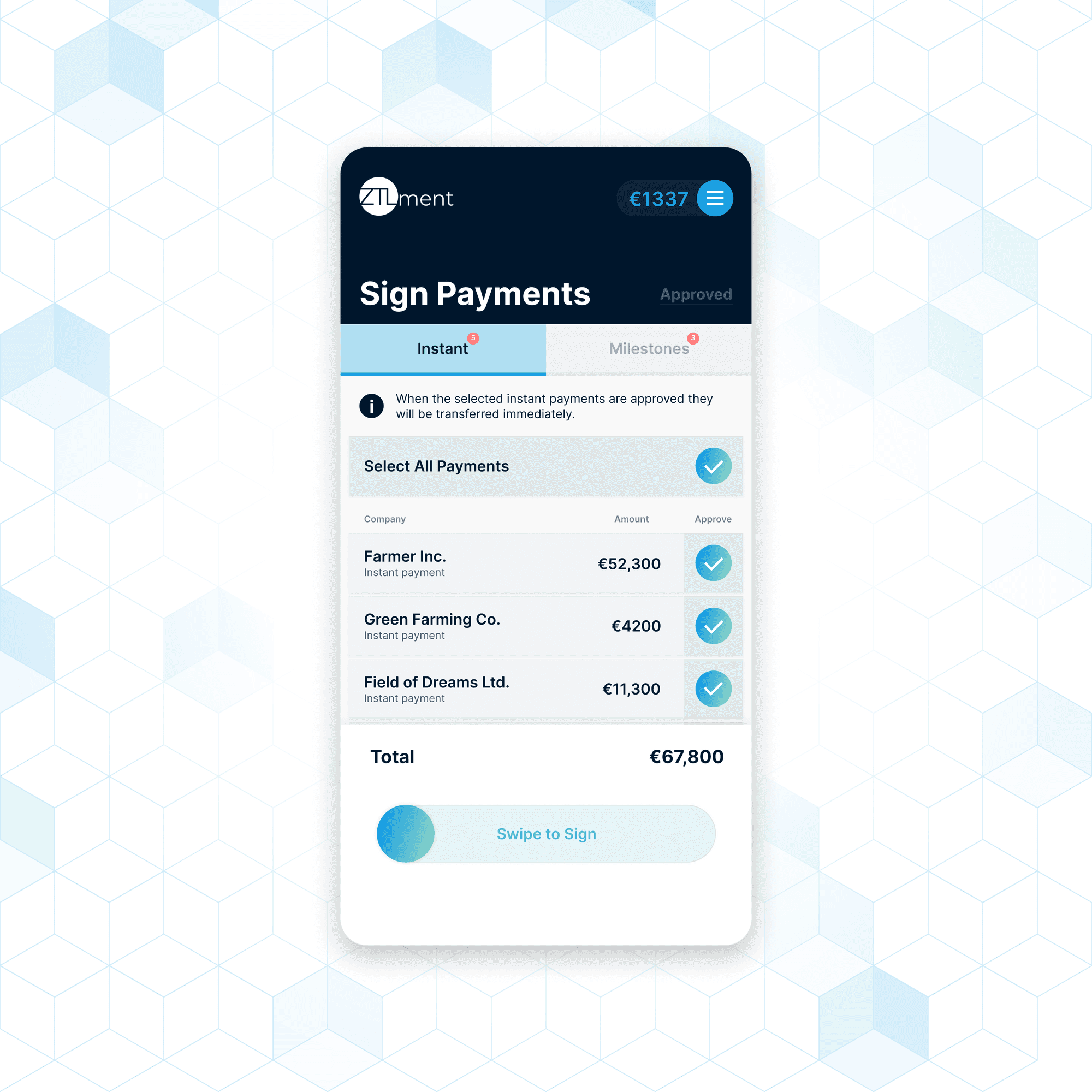

Streamlining the execution of those payments (scheduling, approval and settlement)

Automating the admin and audit work after the payment is made

1. Customising and automating the payment creation flow with ZTLment

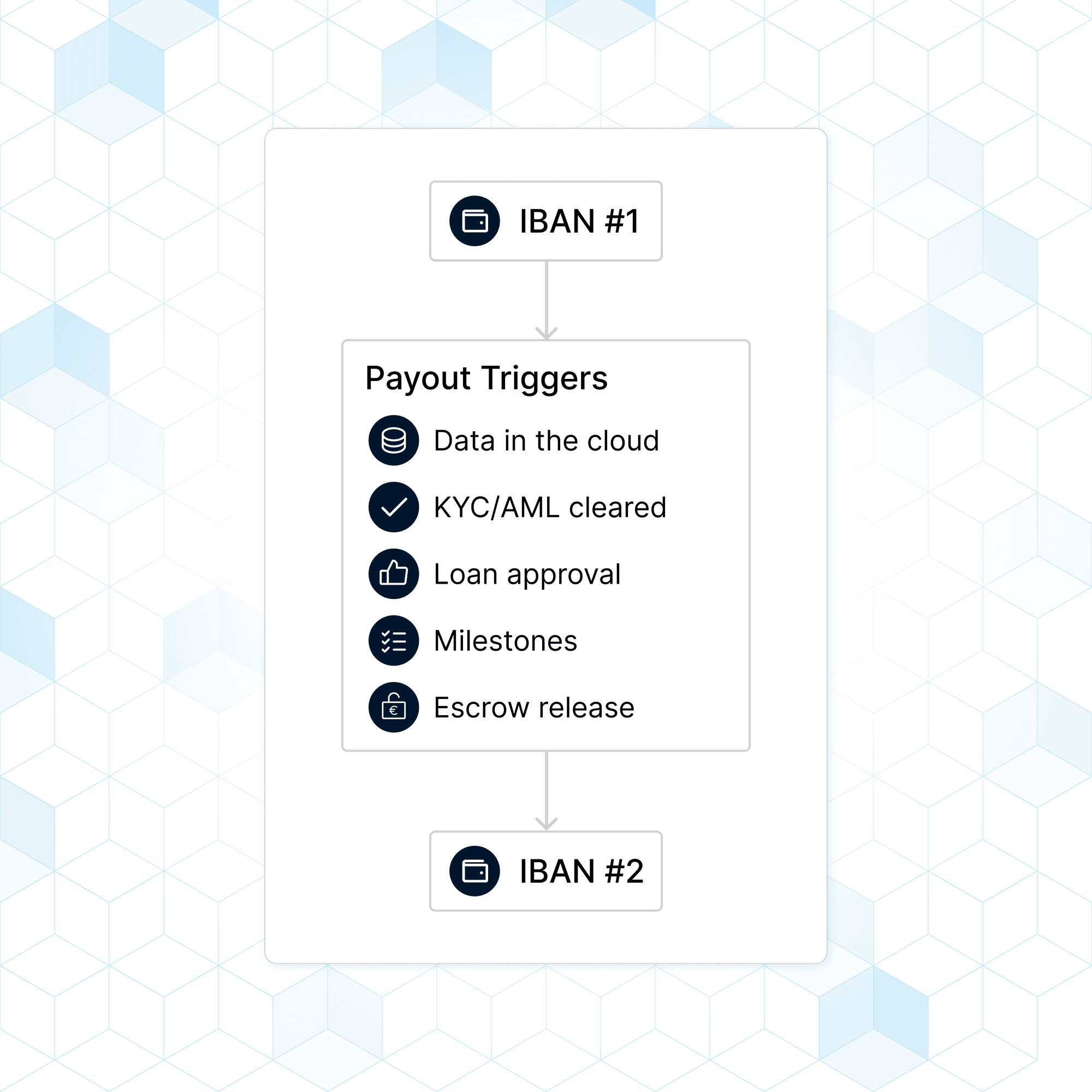

With ZTLment, you can use real-time data events to trigger payment creation for you. Simply connect our API to your back-end or cloud systems, and choose a data event you want to link to payment creation. See the image below for some inspiration for types of data events that could be used:

2. Streamlining and automating the execution of payments

ZTLment enables finance teams to easily build 4-eyes approval flows, customize permissions and even lets you sign off on future payments that will be triggered once specific conditions are met.

3. Automating the admin and audit work after payments

Reconciliation, payment tracking, and auditing have always been manual, tedious work, and is often hindered by lack of complexity in the banking infrastructure typically used for payments.

All of these tasks are streamlined and automated using the ZTLment dashboard, and all relevant data from payments can be sent back to your ERP systems for efficient bookkeeping.

Becoming data-driven in your payments operations'

Embracing the future of finance means becoming data-driven in your payments and finance operations. But in order to become data-driven, you need to invest in products that enable you to connect your products for seamless data and payment flows.

See Harry’s recent post on tips for becoming more data-driven in your finance operations

Some key take-aways:

Invest in an integrated finance product stack

Connect data from your operations to automate payments

Have one source of truth for all your payout data.

Thanks for reading and please, feel free to reach out if you would like to hear more about how to get started with data-driven finance!

Want to know more?

Recent posts

deGrazie speeds up their payout process with ZTLment

24 Apr 2024

How Delayed Payments Can Affect Supplier Relations

2 Apr 2024

ZTLment X Monerium: Automating Complex Payout Processes with Regulated On-Chain Infrastructure

14 Mar 2024

ZTLment strengthens board with three experienced profiles

30 Nov 2023

Simplifying Payouts: A Leap into the Future of Business Transactions

17 Oct 2023

ZTLment Receives Unique European-Wide Licence To Automate Business Payouts Using Fiat Money On Blockchain

13 Oct 2023

Automate Complex Business Payouts with ZTLment's Smart Contract Technology

7 Sept 2023

Create, execute and reconcile Bulk Payouts in under 30 seconds with ZTLment

9 Aug 2023

July 2023 Newsletter

31 Jul 2023

ZTLment Partners With Deloitte and KPI OceanConnect

7 Jul 2023

Revolutionizing Payout Flows: From Manual Intervention to Smart Contract Automation

22 Jun 2023

June 2023 Newsletter

17 Jun 2023

Automating Payouts & The Costs of Manual Payout Processes

7 Jun 2023

May 2023 Newsletter

24 May 2023

Scaling the energy market: blockers and solutions

22 May 2023

Overcoming Challenges in Carbon Project Financing

19 May 2023

Demystifying blockchain: the future of finance with ZTLment

11 May 2023

A single ledger for certificates and money

9 May 2023

ZTLment featured in MIT's "4 business approaches to blockchain"

28 Apr 2023

A guide to conditional payments

28 Apr 2023

Trust and transparency in the net zero economy

28 Apr 2023

April 2023 Newsletter

17 Apr 2023

Agreena goes 'first-ever' on blockchain with ZTLment: tokenized carbon crediting attached to real currency

3 Nov 2022

ZTLment becomes Europe's first regulated payments institution with the Danish FSA

4 Feb 2022