Revolutionizing Payout Flows: From Manual Intervention to Smart Contract Automation

Product

22 Jun 2023

Harry Kearney, COO

In today's fast-paced and digitally driven world, the importance of efficient and error-free payout processes cannot be overstated. Whether it's compensating suppliers, paying employees, or disbursing funds to customers, the way companies handle payouts can greatly impact their operational efficiency, scalability, and customer satisfaction.

Unfortunately, many organizations still rely on outdated manual intervention in their payout flows, leading to numerous challenges and risks.

However, the advent of smart contract technology promises to transform the landscape, offering end-to-end automated flows that mitigate errors, streamline operations, and provide unparalleled scalability. In this article, we will delve into the problem with manual payout processes and explore the transformative power of smart contracts as a solution for the future.

The Problems with Manual Payouts

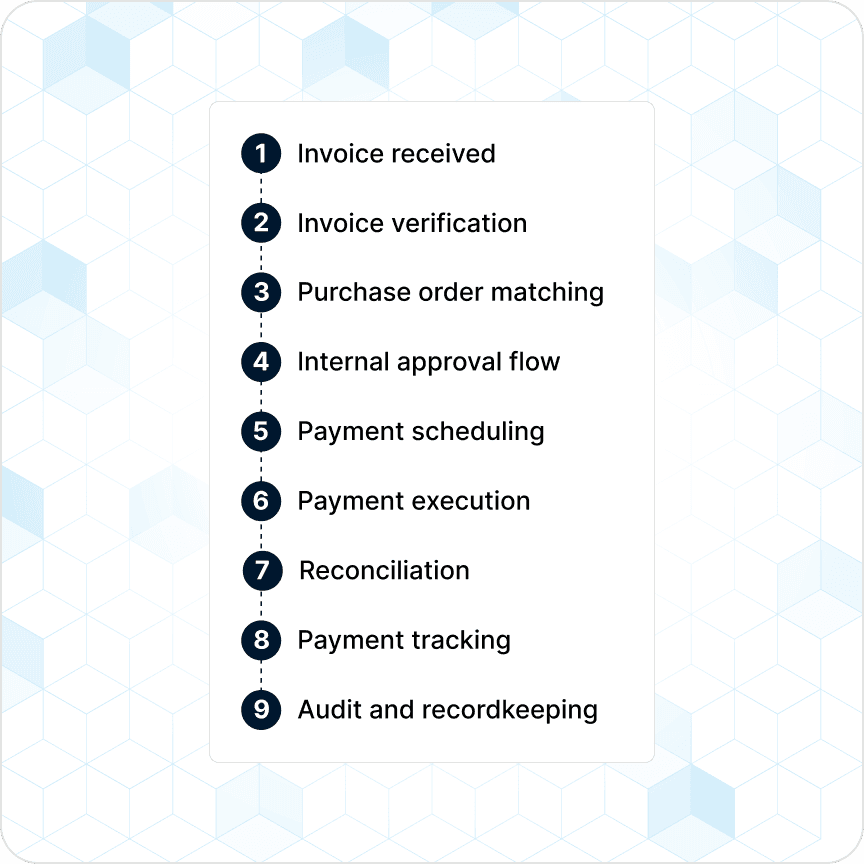

Manual payout processes involve multiple touchpoints, complex workflows, and a heavy reliance on human intervention.

This dependence on manual labor introduces a host of challenges, including:

Increased Risk of Errors: Human errors are inevitable, leading to incorrect payment amounts, delayed transactions, or even misplaced funds. These mistakes can strain relationships with suppliers, employees, and customers, tarnishing a company's reputation.

Lack of Scalability: As businesses grow and transaction volumes increase, manual processes struggle to keep up with the demands. Resource-intensive manual verification and reconciliation tasks become time-consuming and error-prone, hindering operational efficiency and the ability to scale.

Inefficiency and Cost: Manual intervention requires substantial human resources, leading to higher operational costs and longer processing times. Additionally, the need for physical documentation, signatures, and manual approvals further slows down the payout process.

Compliance and Security Risks: Manual payouts often lack robust security measures and may expose sensitive information to potential breaches. Compliance with regulatory requirements becomes challenging, as manual processes are difficult to audit and track.

The Solution: Smart Contract Automation for Payout Flows

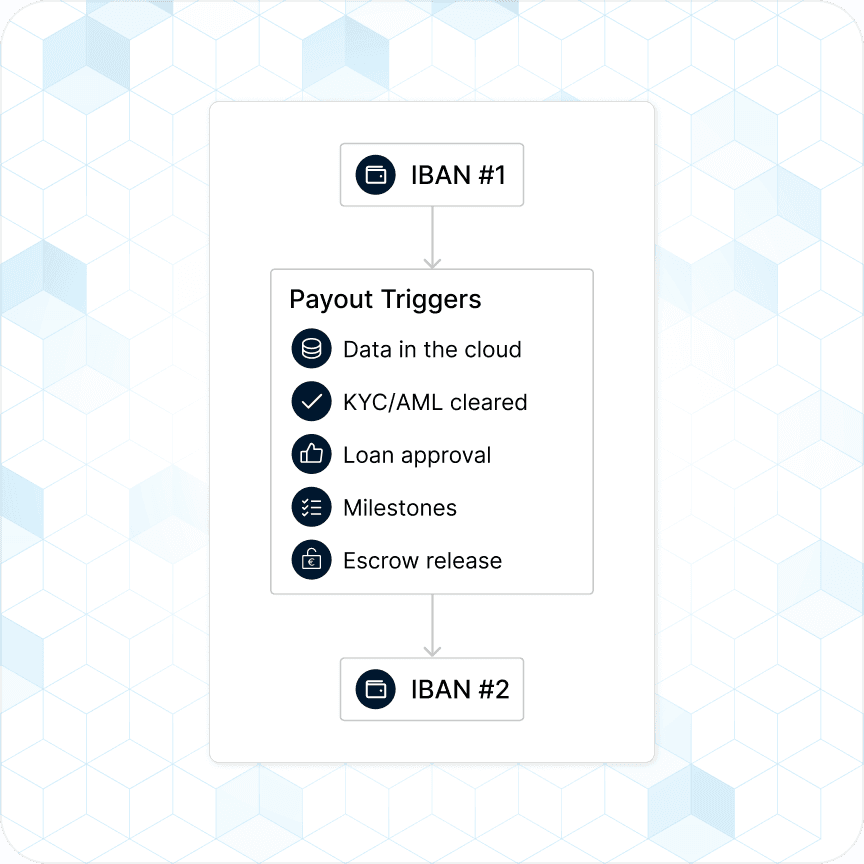

Smart contract payouts are self-executing agreements that use “triggers” to create and execute payments. They enable companies to create and execute payments automatically based on predefined rules when specific data events are registered in their cloud systems. By leveraging the benefits of smart contracts, companies can overcome the limitations of manual payout processes.

As seen in the image below, triggers help connect existing workflow events that are specific to how your company does business. For lending companies, for example, a trigger could be when the KYC/AML for that company has been approved.

For project-based workflows, such as in the carbon or energy market, pre-defined milestones between buyers and suppliers will determine when funds are released. This all happens without the finance team having to lift a finger.

2.2 Benefits of Smart Contract Automation

Implementing smart contract automation for payout flows brings about a multitude of advantages:

Accuracy and Transparency: Smart contracts eliminate human error by executing predefined instructions accurately and transparently. Payment amounts, recipients, and conditions are encoded within the contract, leaving no room for ambiguity or mistakes.

Enhanced Scalability: With smart contract automation, payout processes can seamlessly scale as transaction volumes grow. The removal of manual intervention allows for faster, more efficient processing of large volumes of payments without sacrificing accuracy.

Improved Operational Efficiency: Automated payout flows eliminate the need for manual verification, reconciliation, and approval, reducing operational costs and streamlining processes. Employees can redirect their focus towards value-added tasks, contributing to overall productivity.

Enhanced Security and Compliance: Smart contracts utilize blockchain's inherent security features, providing a tamper-proof and auditable transaction history. Compliance with regulatory requirements becomes more manageable as transactions are transparent and easily traceable.

Real-Time Tracking and Analytics: Smart contract automation enables real-time tracking of payments, offering instant visibility into transaction statuses and valuable analytics. This data empowers companies to optimize their payout processes further, identify bottlenecks, and make data-driven decisions.

The manual intervention and associated risks in traditional payout flows can impede a company's growth and competitiveness in today's digital landscape.

However, by embracing the power of smart contract automation, businesses can revolutionize their payout processes. The advantages of accuracy, scalability, operational efficiency, security, and compliance provided by smart contracts pave the way for a seamless and error-free payout experience.

As companies continue to leverage emerging technologies, the future of payout flows is undoubtedly automated, empowering organizations to scale their operations and drive success in the fintech industry.

Want to know more?

Recent posts

deGrazie speeds up their payout process with ZTLment

24 Apr 2024

How Delayed Payments Can Affect Supplier Relations

2 Apr 2024

ZTLment X Monerium: Automating Complex Payout Processes with Regulated On-Chain Infrastructure

14 Mar 2024

ZTLment strengthens board with three experienced profiles

30 Nov 2023

Simplifying Payouts: A Leap into the Future of Business Transactions

17 Oct 2023

ZTLment Receives Unique European-Wide Licence To Automate Business Payouts Using Fiat Money On Blockchain

13 Oct 2023

Automate Complex Business Payouts with ZTLment's Smart Contract Technology

7 Sept 2023

Create, execute and reconcile Bulk Payouts in under 30 seconds with ZTLment

9 Aug 2023

Pioneering data-driven finance for customisable and fully automated payment flows

1 Aug 2023

July 2023 Newsletter

31 Jul 2023

ZTLment Partners With Deloitte and KPI OceanConnect

7 Jul 2023

June 2023 Newsletter

17 Jun 2023

Automating Payouts & The Costs of Manual Payout Processes

7 Jun 2023

May 2023 Newsletter

24 May 2023

Scaling the energy market: blockers and solutions

22 May 2023

Overcoming Challenges in Carbon Project Financing

19 May 2023

Demystifying blockchain: the future of finance with ZTLment

11 May 2023

A single ledger for certificates and money

9 May 2023

ZTLment featured in MIT's "4 business approaches to blockchain"

28 Apr 2023

A guide to conditional payments

28 Apr 2023

Trust and transparency in the net zero economy

28 Apr 2023

April 2023 Newsletter

17 Apr 2023

Agreena goes 'first-ever' on blockchain with ZTLment: tokenized carbon crediting attached to real currency

3 Nov 2022

ZTLment becomes Europe's first regulated payments institution with the Danish FSA

4 Feb 2022